We serve consulting services of below mentioned subsidy scheme

Aatmanirbhar Gujarat Scheme for assistance to MSMEs

Under the Gujarat Government Policy 2022, the following subsidy is given to the new as well as existing MSME units on term loan, which term loan is taken for the purchase of a new Plant & Machinery and construction of a factory building or shed.

Subsidy details as bellows for Manufacturing Industry

Assistance of Capital Investment Subsidy to Microenterprises

Microenterprises shall be eligible for capital investment subsidy based on the category of taluka

| Category of taluka | Quantum of incentive |

| Category 1 | 25% of term loan amount up to INR 35 lakhs. |

| Category 2 | 20% of term loan amount up to INR 30 lakhs. |

| Category 3 | 10% of term loan amount up to INR 10 lakhs. |

Assistance for Interest Subsidy to Micro, Small and Medium Enterprises in manufacturing sector:

| Category of taluka | Quantum of incentive |

Category 1 | Interest subsidy @ 7% on Term Loan with the maximum amount of Rs. 35 lakhs perannum for a period of 7 years |

| Category 2 | Interest subsidy @ 6% on Term Loan with the maximum amount of Rs.30 lakhs per annum for a period of 6 years |

| Category 3 | Interest subsidy @ 5% on Term Loan with the maximum amount of Rs.25 lakhs per annum for a period of 5 years |

| |

Net SGST reimbursement to Micro, Small and Medium Enterprise(MSMEs)

MSMEs shall be eligible for reimbursement of net SGST based on the taIuka category of the project subject to following ceilings:

| Category of taluka | Quantum of incentive |

| Category 1 | 100% of net SGST for 10 years up to 7.5% of eFCIp.a. |

| Category 2 | 90% of net SGST for 10 years up to 6.5% of eFCIp.a. |

| Category3 | 80% of net SGST for 10 years up to 5% of eFCIp.a. |

The period of 10 years shall be from the date of commencement of commercial production.

| Taluka Category | Capital Subsidy | Interest Subsidy |

| Category 1 |

@25 % of eligible Term Loan Amount subject to a maximum amount of Rs. 35 lakhs; If the Eligible FCI is over 10 Crores, additional INR 10 lakhs will be given |

@7% of term loan amount disbursed with the maximum amount of Rs. 35 lakhs per annum for 7 years |

| Category 2 |

@20 % of eligible Term Loan Amount subject to a maximum amount of Rs. 30 lakhs; If the Eligible FCI is over 10 Crores, additional INR 7.5 lakhs will be given |

@6% of term loan amount disbursed with the maximum amount of Rs. 30 lakhs per annum for 6 years |

| Category 3 (including Municipal Corporation areas) |

@10 % of eligible Term Loan Amount subject to a maximum amount of Rs.10 lakhs; If the Eligible FCI is over 10 Crores, additional INR 5 lakhs will be given |

@5% of term loan amount disbursed with the maximum amount of Rs. 25 lakhs per annum for 5 years |

|

||

Service Sector MSMEs– under Policy 2022

Gujarat Government is decided to extend incentives to Service sector covered in MSME. In view of the potentiality of the service sector, it has been decided to widen the scope of the service sector. Besides the 22 service categories already defined in the Gujarat Industrial Policy 2015, the following champion services are also identified to cover them under the eligible service sector for incentives:

- Financial services

- Health services

- Transport and logistics services

- Audio Visual services

- Construction related engineering services

- Environmental services

Subsidy details as bellows for Service Sector Industry

| Taluka Category | Interest Subsidy |

| Category 1 | @7% of term loan amount disbursed with the maximum amount of Rs. 35 lakhs per annum for 7 years |

| Category 2 | @6% of term loan amount disbursed with the maximum amount of Rs. 30 lakhs per annum for 6 years |

| Category 3 (including Municipal Corporation areas) | @5% of term loan amount disbursed with the maximum amount of Rs. 25 lakhs per annum for 5 years |

|

|

Subsidy details as bellows for Service Sector Industry

The scheme is to extend support to MSME to get quality certification to introduce quality product in competitive market.

Quality Certification

With a vision to encourage domestic products to be globally competitive, the Subsidy policy will support to obtain ISI/WHO-GMP/Hallmark certifications & other national/International certification from Quality Council of India. 50% of fee payable to Recognized National/International Certification (i.e. ISI/WHO-GMP/Hallmark certifications, etc.) and 50% cost of testing equipment and machinery required for that certification, totaling up to maximum amount of Rs. 10 lakhs.

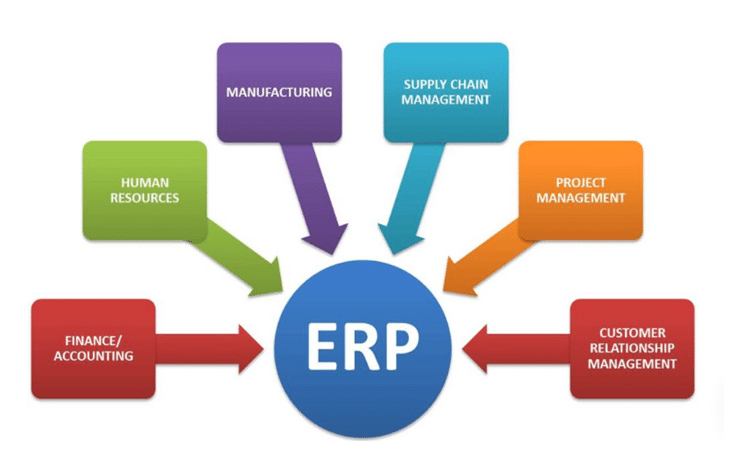

ERP Assistance

65% of the capital cost for installing the Enterprise Resource Planning (ERP) system subject to a maximum amount of Rs.1,00,000/-

Disclaimer: All the efforts have been made to avoid errors or omission. In spite of this, errors may creep in. Information contained above is tried to be latest compilation and up to date, still no guarantee is given that the information provided is correct and complete. No one is responsible for and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance of any information contained above. It is further suggested that to avoid any doubt reader should cross – check all the facts, law and contents with the original government publication, guidelines or notification issued time to time.